Acquisition-Fi 0 Forex

Acquisition strategy for Fi's 0 forex debit card

Is Fi 0 Forex DC ready for acquisitions?

Yes

- [usage] Decent base of transacting users

- [aha moment]bwho have experienced 0 forex cost savings

- and who spread the word about the product.

Stage of Product

Early Scaling

We have a base of early adopters who Use, show repeat transaction behaviour and refer the product.

Product

Pain Point -

User Insight:

International payments carry higher anxiety than domestic payments, given higher unfamiliarity.

In the absence of one solution for all international transactions, Users end up transacting with high forex fees and cash exchange at predatory exchange rates.

Current solutions:

- Forex cards

- Credit cards (with or without 0 forex)

Problems with current solutions:

- High forex markup (in case of non-0 forex CC) and cross currency conversion fee (forex cards)

- High ATM withdrawal fee

- Other unknown, creeping charges- Inactivity charges, Reload charges, Late payment interest

- Ease of access

Core value proposition of Fi 0 Forex Card-

- 0 forex fees

- Lowest ATM withdrawal fee - ₹100

- Not restrained by credit limit, linked to money in savings account

- No credit checks, no credit application hassles.

Usage Condition:

- Minimum balance of ₹50,000 to avail 0 forex benefits and free debit card

- Minimum balance of ₹25,000 to avail 0 forex upto ₹50,000 and free debit card

ICP

ICP 1 | ICP 2 | ICP 3 | |

Name | Avid Travellers | Beginner Travellers | Techbros |

Age Range | 28-40 | 24-35 | 25-35 |

Gender | Any | Any | Any |

Location | Tier 1 | Tier 1 | Tier 1 |

Income level | >20L | >10L | >10L |

Occupation | Mid/Senior Mnaagment at Corporate, Mid to senior level execs at startups, Consultants, Bankers, Lawyers, | Junior to Mid level execs, ICs at corporates or startups, Analysts/ Junior consultants | Employees at New Age, Tech Startups, Early stage founders |

Marital Sttaus | Any | Single, Dating | Any |

Kids/No Kids | Any | No | Any |

Online behaviour | Social Media: Twitter, Reddit, InstagramPublication: Moneycontrol, The KenContent: Netflix, Apple tv, Hotstar, YoutubeUsers of Cult, BluSmart, Zerodha | Social Media: Instagram, Snapchat, TwitterContent: Netflix, Hotstar, Prime, Youtube | Social Media: Twitter, Reddit, GrapevinePublication: The Ken, YourStory, Substack, MediumContent: Netflix, Prime, Hotstar, Youtube |

Offline behaviour | Premium Dining Shops at H&M, Zara, New experiences, Networking clubs, Cult, Other premium gyms | Budget Dining-PubsMovies, Shops at H&M, Urbanic, NewMe | Dining Out, Movies |

Time vs Money | Time | Money | Time |

Problem | Forex cash management is a painForex card management is a painPrioritizes convenience | Wants to save forex chargesWants one card for all money related problems | Wants to save forex charges |

Problem Awareness | High | Medium | High |

Use Case | Leisure Travel | Leisure Travel | Business Subscriptions |

Use Case Frequency | 2 or more | Once a year | Once a month |

Annual International Spends | 2-5 lacs | 50k-1lac | <20k |

How do they take Decisions | Self Research | Rely on friends, Other expeirenced travellers | Self Research |

Typical Countries Visited | ME, SEA(luxury), Europe, Turkey | Budget SEA, Nepal, Sri Lanka | NA |

Travels with | Family, Friends | Solo, Friends | Solo |

ICP Prioritisation

Prioritising two core ICPs for acqusiition deepdive on the basis of above inputs:

- Avid Traveller

- While CAC is high for this user, their high usage would end up resulting in this ICP becoming a high LTV user, neutralising the cost over time

- Beginner Traveller

- Inertia to shift being high in this category , Building trust and usage foundation with this user has high potential of generating long term value as this user increases their travel use case over time and starts relying on Fi as their go to product.

Link to ICP and ICP Prio here

Market

India Outbound Tourism is currently a $15B industry, expected to grow to $60B by 2031.

Growth strategy for Fi's 0 forex card should aim at capturing a portion of this market's spends to happen via Fi

TAM, SAM, SOM:

TAM- Total India Outbound Tourism Market Size

SAM : 70% x TAM [30% users dont meet the condition]

SOM: 5% x SAM taking into account

- Awareness levels for 0 forex debit card

- Compeition from bank & fintechs

- Foreign currency exchange at home or airport for international usage

Competition:

Fi competes with Forex Cards, Credit Cards & other Debit Cards.

- Foreign currency exchange at home or airport could be considered competition but given cash-first nature of many top travel hubs, it is difficult to replace its value.

Competitive Benchmarking here

Channels

Current Channels :

- Google UAC

- Communication: Save on currency conversion charges with 0 forex markup

- Audience :

- Age 25-45

- Tier 1

- Performance of campaign:

CTR

2%

Install Conversion

30%

Account Created

7%

TU Conversion

8.33%

- In-App Cross-sell

- PNs in First 15 days of a new user to build awareness

- Monthly Whatsapp with International Travel Offers

- Home Page Widget communicating 0 Forex

- Impact: 10% increase in overall international transacting base

Proposed Channel Experiments :

Objective is to reach users at the stage in their travel planning where they have taken travel decision and are managing logistics for the trip. Given a very use case heavy nature of the product, the strategy needs to focus on being present at the time of travel research to capture high intent users in the early scaling stage.

- Organic

- Google SEO Experiment of 4 keywords:

- Best Forex Card

- International debit card

- Niyo global forex card

- Scapia

- Engagement on Quora, Reddit, Grapevine

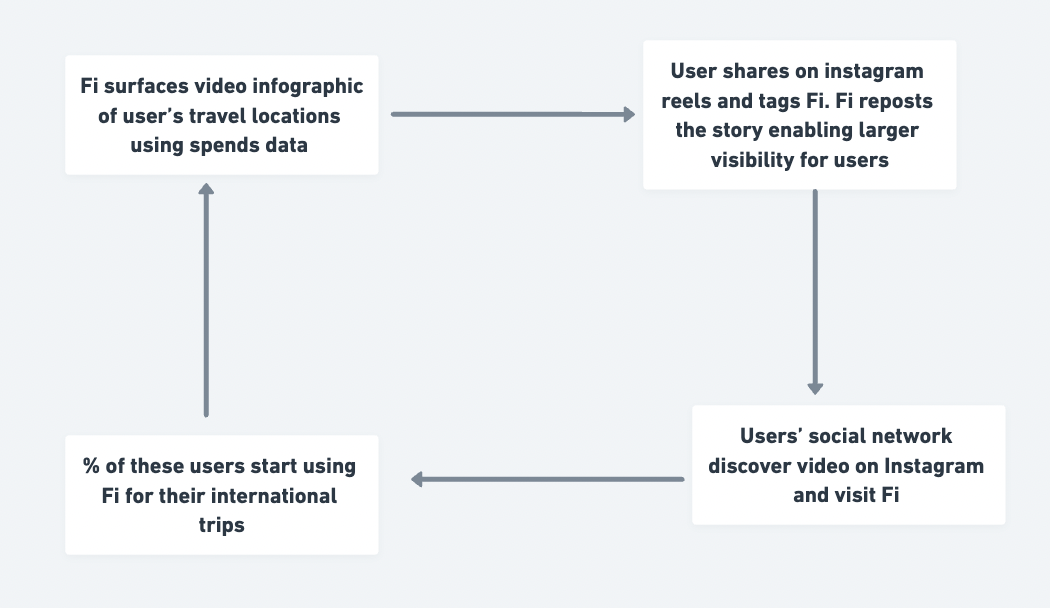

- Content Loop: User's travel map video infographic with Fi CVP

- Partnerships

- Partnerships with Atlys, Headout, Metanoia

- Referral

- Additional discovery touchpoints on the basis of user's app activity

- Single CTA for referring

- A/B Experiment in referee communication on the basis of referrer's transaction activity [first transaction OR ₹15k spends]

- Milestone referral

ORGANIC [SEO]

JTBD: Fullfill search intent of users looking for payment modes for international travel

Platform users use to search for solutions(in order):

- Quora

Experiment:

- Optimise for the following keywords for google SEO

- Best Forex Card

- International debit card

- Niyo global forex card

- Scapia

- Quora: Engage on content with 'Forex Card' and 'International travel card' keyword

- Reddit: Engage on r/travel and r/CreditCardIndia

Google SEO

User Insight:

- Users who are avid travellers are aware of the implication of forex markup, the hassles attached to forex cards and given the strong brand presence of competition, end up searching for competition brands

- Beginner travellers are not highly aware of forex markup, hassles of forex cards and end up searching for forex cards, currency exchange.

Given we have not explored SEO as a strategic growth channel to boost organic uptick for the product, start off with 4 keywords that will enable relatively quicker proof of concept. Considering effort, time & scale, recommending the following:

- Best Forex Card

- International debit card

- Niyo global forex card

- Scapia

Research-

Link here

Articles:

Access Whimsical here

Covering the ground & being present where users search:

- Quora

- Branded Responses on topics and questions for the following keywords:

- Forex Card

- International Travel Card

- Participate in international travel related threads on following subreddits:

- r/travel

- r/CreditCardIndia

- (p2)Grapevine

- Content engagement on international travel related threads on Communities:

- Personal Finance

CONTENT LOOP

Hook: Travel Map video Infographic with an overlay of core messaging 'I saved X on my trip to Vietnam with Fi'

Content Creator: Fi

Content Distributor: User

Distribution Channel: Instagram

Sample Creative:

Loop Design:

To ensure tracking of acquisitions using this channel:

- Plug=in user's referral flow in the description with the hook 'You earn everytime a friend gets inspired by your travels and starts using Fi'

PARTNERSHIPS

Steps to arrive at choice of partners:

Prioritisation of Partner

Steps:

- Willingness: Is the partner willing to partner?

- Partners with competing products [for eg, Thomas Cook has its own forex card] wont partner

- Partners with robust ad monetization strategy would prefer advertising association

- Cost

- Effort [Tech Effort]

- Potential Scale

- Time to go Live

Prioritised Partners(in order of priority) for Quick proof of concept:

- Atlys

- Headout

- Metanoia

Partners for Scaling (given lower willingness and longer deal negotiation cycle)

- SOTC

- Airbnb

- Orient

Link here

Partnership Construct:

FREE debit card with 0 forex for users opting via this journey. Post consent, user gets the debit card delivered and is then required to onboard on app and add money for usage.

Differentiated benefits via this construct- Tier requirements of maintaining ₹50,000 to avail 0 forex benefit and free debit card is waived off in interest of high potential of international usage

Product Flows for Different types of Journey

Completely digital journey, like e-visa

Digital journey where Address is being collected in the flow, like Stamp Visa & Foreign Currency

Journey with Human involvement like High ticket travel package bookings

REFERRAL

Step 1 --> Bragworthy factor of product

2.5% cost savings on every international transaction

Step 2 --> Platform Currency

Options:

- Cashback in linked savings account

- Cons: Can be easily withdrawn

- Fi Coins

- Weak perception of coins

- While user will earn Fi Coins for referral, this in itself might not increase international spends as subsequent transactions are not eligible for Fi coins

- Transaction linked cashbacks

- More complicated to understand than simple, flat cashback

Conclusion:

Transaction linked cashbacks incentivizes user and increases transactions on card. The effort required will have to be met with a reward that neutralizes the inertia.

Step 3 --> Define WHO will see referrals

- User who has experienced 0 forex benefits

- A/B experiment to be run to understand referral impact between surfacing the referral communication

- After FIRST international transaction, OR

- After P70 transaction amount generally spent during an international trip is met. For the purpose of this doc, lets say it is 15k

User Story

Step 4 --> How will they Discover

- If user is app active

- Home nudge

- Debit card page banner

- Transaction receipt

- If user is app inactive,

- Whatsapp communication at the end of the trip - You saved X, refer your friends

Current Referral Flow

- Bottom Banner leading to Bank account (salary) referral

- 4 CTAs for sharing - Whatsapp, SMS, Generic Channel & Copy Code

Proposed Flow

- Discovery on the basis of user's app activity

- 4 modes of discovery

- Single CTA on Referral page

Whimsical here

Communication --> 'Tell your friends about your forex savings & earn rewards'!

Sample banner -->

Step 5 --> Referee experience

Channel: Whatsapp

Segment- After FIRST international transaction

Communication:

Segment- After ₹20,000 spends on the card

Note- savings amount mentioned in the message to be personalised basis user's savings

Communication:

Post click experience will remain standard as the link will lead to play store

Step 6 --> Tracking

Step 7 --> How does the user keep referring?

Milestone Design for Referrer

Thought Process: Went over two constructs-

- first was giving users a % cashback on all spends upto a certain limit depending on how many users they had referred [for eg, on reaching 5 referrals, get 1.5% cashback on all spends upto ₹1000]

- second gave flat rewards as highlighted below

Choosing to go ahead with 2 since the first would create a lot more confusion and unanswered questions, potentially leading to failed conversion.

- Cashback administered on non-ATM transactions made using the card

- Minimum. transaction barriers would apply

- Referral is successful when referee has completed their first international transaction

LTV: CAC

Blended LTV: CAC ratio to measure impact of acquisitions across organic, partnerships & referral

LTV = Spends per card per month x Number of active months x Margin = ₹750

CAC (blended across channels) = Total Cost / Total acquired users = ₹471

LTV: CAC Ratio = 1.59:1

Working here

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.